Promis.co (eInvoices)

eInvoicing and API Platform Link to heading

Commercial Project Overview Link to heading

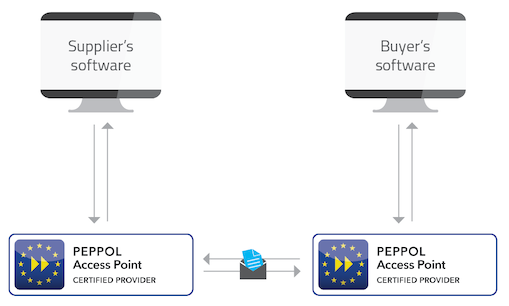

As a software engineer at Promis.co, I worked on scaling and modernizing a fintech API SaaS platform that facilitated the interchange of accounting and business transaction data between cloud accounting platforms. Promis served as the eInvoicing partner to OZEDI, Australia’s premier eInvoice/PEPPOL access point provider.

Platform Capabilities Link to heading

API Integration Services Link to heading

- Cloud accounting platform integration - seamless data interchange between major accounting systems

- eInvoicing/PEPPOL connectivity - direct integration with Australia’s electronic invoicing infrastructure

- Business transaction processing - automated handling of complex accounting workflows

- Multi-tenant architecture - supporting businesses of all sizes regardless of technology gaps

- Government compliance - meeting Australian eInvoicing standards and regulations

Target Market Link to heading

- Government agencies requiring compliant eInvoicing solutions

- Tier 1 software companies needing accounting system integration

- Large corporations implementing electronic invoicing capability

- Businesses of all sizes seeking to bridge technology gaps in their accounting workflows

Technical Contributions Link to heading

Platform Modernisation Link to heading

- Legacy system migration - transitioned existing JavaScript codebase to serverless cloud functions (Lambda)

- TypeScript implementation - converted legacy JavaScript to fully typed TypeScript architecture

- 100% unit test coverage - implemented comprehensive testing suite for production reliability

- Serverless architecture - migrated to AWS Lambda for improved scalability and cost efficiency

- API reliability - built robust integrations that simplified complex accounting workflows

Integration Architecture Link to heading

- Cloud accounting APIs - deep integration with major accounting platform providers

- PEPPOL network connectivity - direct integration with Australian electronic invoicing infrastructure

- Government system integration - compliance with official eInvoicing standards and protocols

- Error handling and recovery - robust systems for handling accounting data inconsistencies

- Real-time processing - immediate transaction processing and status updates

Business Impact Link to heading

Market Reach Link to heading

- Thousands of Australian businesses benefited from simplified accounting workflows

- Government partnership - strategic alignment with national eInvoicing initiatives

- Enterprise clients - served Tier 1 software companies and large corporations

- SME enablement - democratised access to advanced accounting technology regardless of business size

Technical Innovation Link to heading

- Serverless-first approach - pioneered cloud-native architecture for accounting integrations

- Type safety implementation - improved code reliability through comprehensive TypeScript adoption

- API-first design - created flexible integration points for diverse accounting systems

- Quality assurance - achieved 100% test coverage ensuring production stability

Professional Development Link to heading

Fintech API Expertise Link to heading

- Accounting system integration - deep understanding of cloud accounting platform APIs

- Electronic invoicing standards - expertise in Australian PEPPOL and eInvoicing regulations

- Business transaction workflows - comprehensive knowledge of accounting data interchange patterns

- Government compliance - experience with regulatory requirements for financial data processing

Technical Architecture Link to heading

- Legacy system modernisation - proven experience migrating JavaScript to TypeScript at scale

- Serverless architecture - expertise in AWS Lambda deployment and optimisation

- Test-driven development - commitment to 100% test coverage and code quality

- API reliability engineering - building robust integrations for mission-critical business processes

This role provided essential experience in fintech API development, government compliance requirements, and the technical challenges of integrating diverse accounting systems at scale across the Australian business landscape.